Johnson & Johnson MPL File Overview

GOAL: To provide a wholistic overview of the new J&J Benefits and MPL Process. This overview should cover all appropriate setup, configuration, reporting and considerations to make along the way.

NOTE: Johnson and Johnson is only for LTD. Boards will use OTIP/COWAN for everything BUT LTD, and then Secondary Benefit Provider = JOHNSON for LTD only.

PROCESS OVERVIEW

BOARD CONTROL > BENEFITS > BENEFIT PROVIDER CONFIGURATION

**JOHNSON and JOHNSON do not have this configuration**

BOARD CONTROL > BENEFITS > BENEFIT CARRIER CODE MAINTENANCE > JOHNSON

**Ensure all appropriate Employee Group records are configured**

Action Icon > Modify

**Confirm Client ID, Plan, Class and Division Codes are configured accordingly**

Note: The Client ID, Plan and Class are provided Johnson & Johnson. These values are constant for each group and will not change.

Any Allowances that are applicable to Benefit Salary should be configured here to be included in the Benefit Salary on the J&J MPL File Generation.

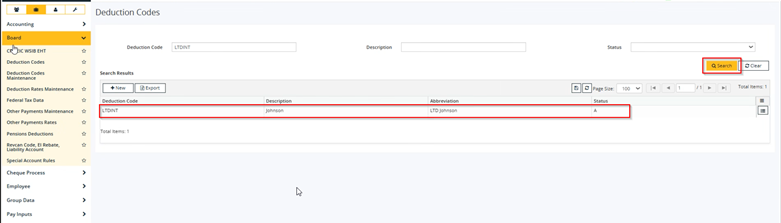

PAYROLL > BOARD > DEDUCTION CODES

**Ensure LTDINT Deduction Code is configured**

Action Icon > Modify

**Ensure the LTD Deduction Code is Active**

PAYROLL > BOARD > DEDUCTION CODES MAINTENACE

**Ensure that both GL Accounts are configured alongside Algorithm Code = JOHNSON**

Note: Under Code Type, choose LTD for LTD configuration.

It is important to note that Home & Auto was coded in this this is another form of coverage that J&J provides, however is not currently used by any Boards so far.

This was coded in so that it can be available for any future customer who might opt in.

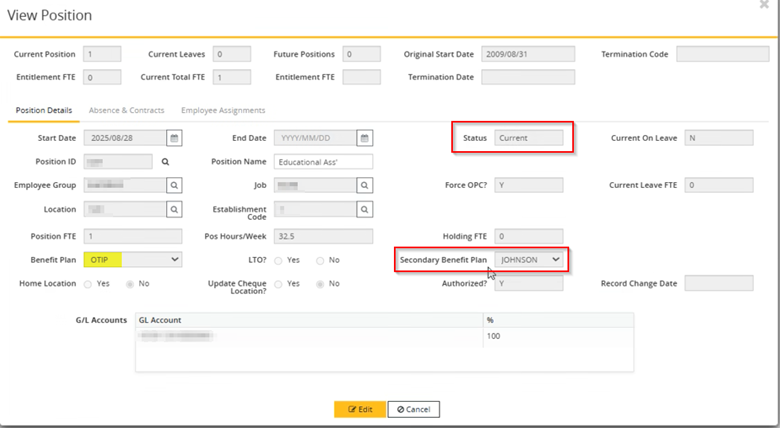

STAFF MANAGERMENT > EID > POSITION & ASSIGNMENT

**Secondary Benefit Plan = JOHNSON**

Note: This can ONLY be configured for a CURRENT Position. It can NOT be updated for a Future Position record.

BENEFITS > IMPORT PAYROLL DEDUCTION FILE > J&J

**Configure Benefit Plan = JOHSNON & Start Date (The End Date will automatically populate)**

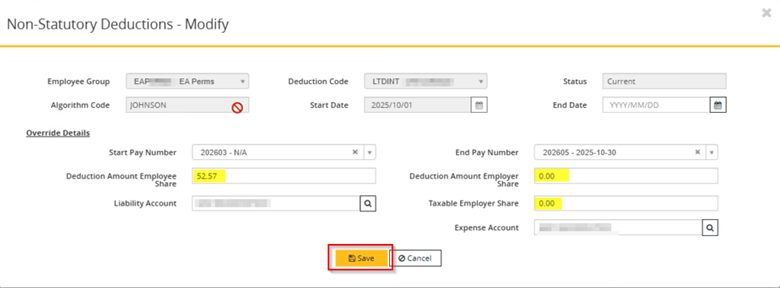

PAYROLL > EMPLOYEE > NON-STATUTORY DEDUCTIONS > EID

**The accumulation of Monthly records for JOHNSON // LTDINT will generate here**

Action Icon > Modify

**Here you can see the Employee and Employer (Taxable) Share amounts**

Note: The Share amount comes back from JOHNSON & JOHNSON via the Import Payroll Deduction File. There are no calculations within HRP for this, it is imported and applied to the Pay Register.

Additional Note: It is possible to manually update the Share values; however, this discrepancy will be noted in the J&J Discrepancy Report.

- Share Value changes here are not caught in Entitlement

Note that the Employer Share is typically 0.00 here. Share is mostly paid by Employee.

IMPORTANT NOTE: The Non-Statutory Deduction records are on a per month basis and map against the Cheque Dates to apply for 2 Pay Periods in each month.

PAYROLL > GROUP DATA > PAY PERIOD CALENDAR > PAY NUMBER

**Cheque Date is what is used to apply against the Non-Statutory Deductions record**

Note: In the scenario where 3 Cheque Dates fall under 1-month Non-Stat Record, it will only apply to 2 Pay periods.

PAYROLL > PAY PROCESS > SCHEDULE GROUPS > PAY RUN > SUBMIT

**LTDINT Deduction will be present under Pay Register**

REPORTING OVERVIEW

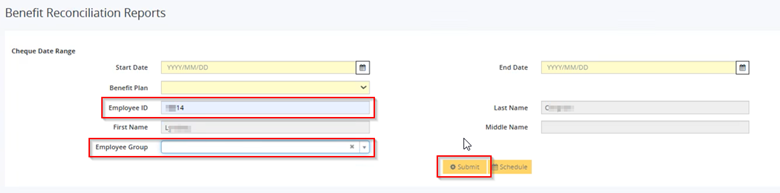

PAYROLL > AD HOC BOARD > BENEFIT RECONCILIATION REPORT

**Configure Benefit Plan = JOHNSON and the desired Date Range**

Note: The report can also be generated on a Specific Employee or Employee Group basis using a more refined Search functionality.

**Refined Reports can be generated for Specific EID or Employee Groups**

REPORTS > PROCESS REPORTS

**Two Reports are generated here**

These reports will account for the currently processed pay periods within the configured one-month duration.

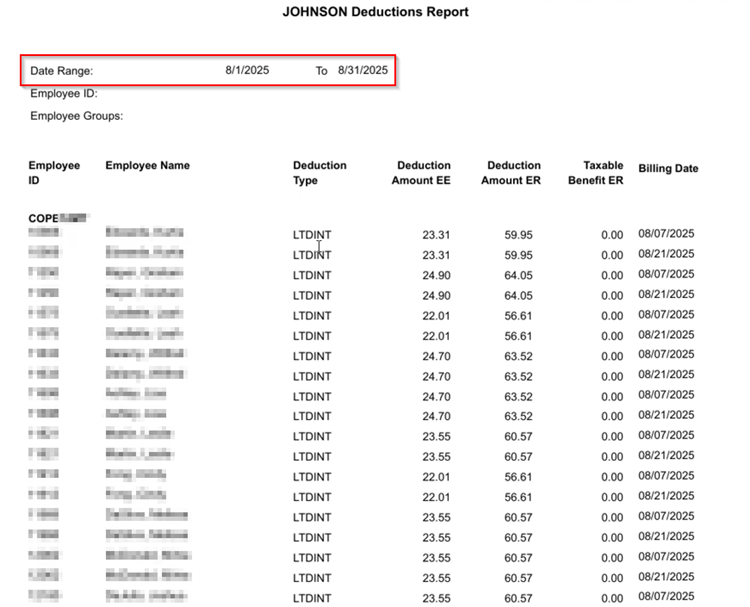

REPORTS > PROCESS REPORTS > JOHNSON Deductions Report

**Deduction Breakdown by Employee Group – per Employee**

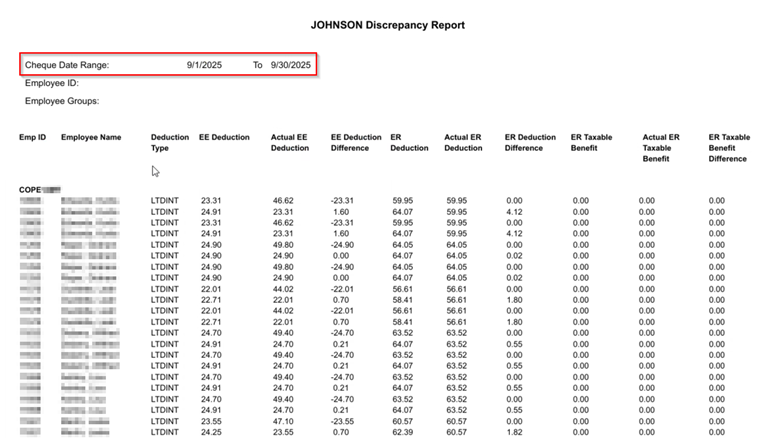

REPORTS > PROCESS REPORTS > JOHNSON Discrepancy Report

**Deduction Breakdown and discrepancy amount per Employee Record**

Note: This report is used for manual investigation and verification of Johnson Deduction Values for both Employee and Employer Share.

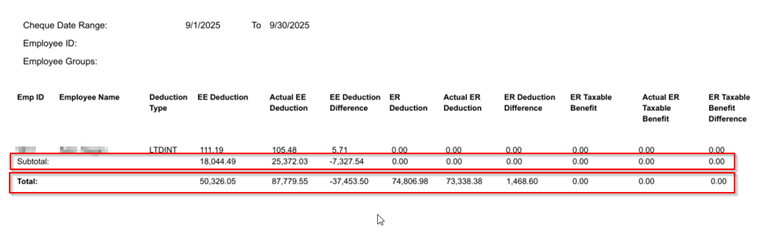

IMPORTANT NOTE: The Subtotal represents the Total on a per group basis, while the TOTAL represents the sum of all Employee Groups.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article